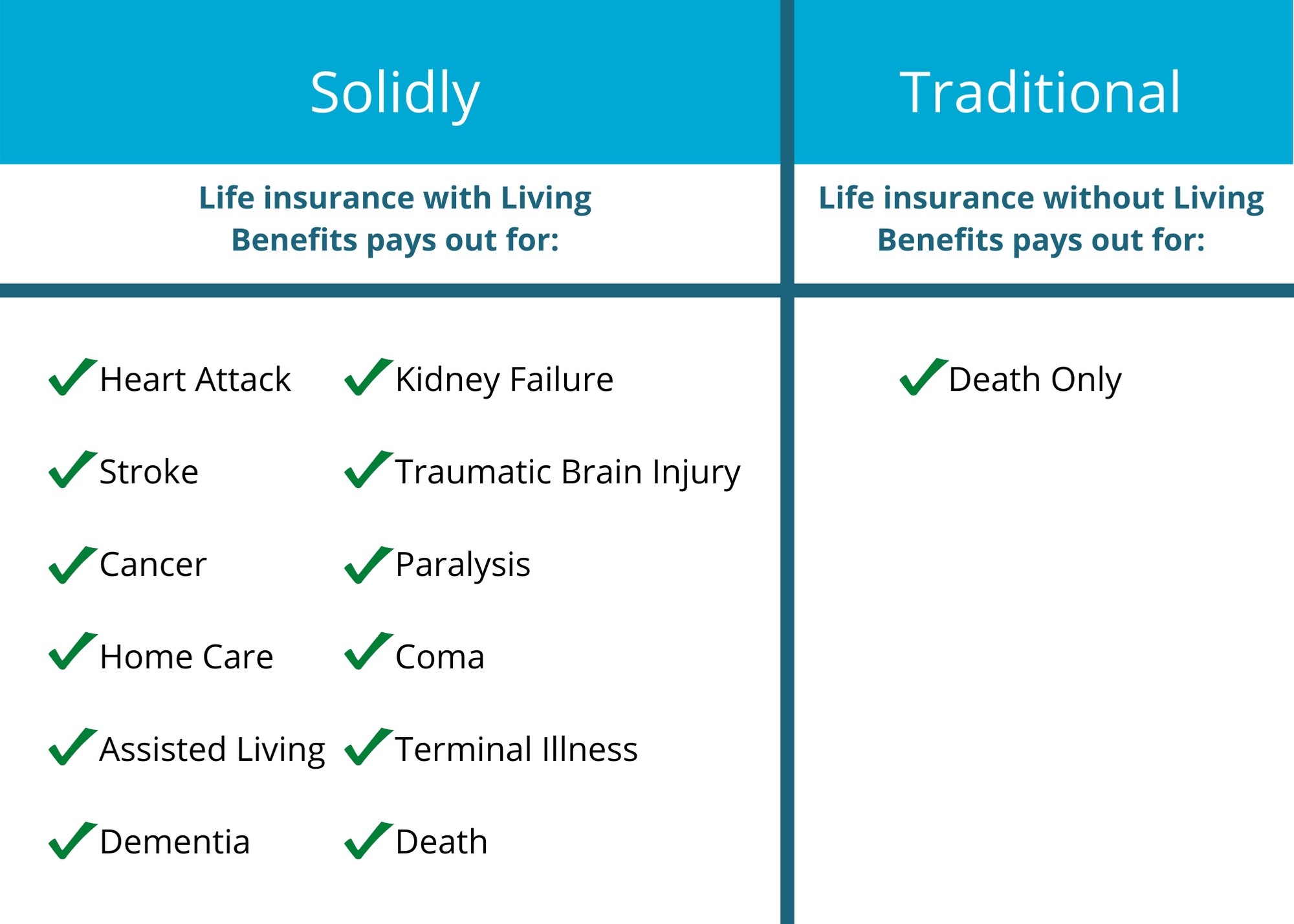

Most Life Insurance Policies only pay a benefit after you pass away. For years that’s all we came to expect.

Not with us.

Meet Solidly.

How it works

The Solidly approach is built around your needs. Chatting with one of our Solidly Guides ensures you’ll quickly find the best living benefits life insurance options. We’re here for you – to answer questions, give advice, and help you plan for your future.

Think of us as life insurance friends.

1. Begin with a click

Tap the button below and fill out the form.

2. Make a plan

A Solidly Guide will help find coverage that works best for you.

3. Live Solidly

Rest well knowing you and your family are covered, come what may.

Get more life from your life insurance

We call them living benefits – a life insurance policy that lets you draw on the entirety of your benefit amount when you need it the most. Severe accidents, unforeseen medical events, or terminal illness – whatever comes your way, you’ll be ready to take it on with Solidly.

Your family will thank you.

(And so will your wallet.)

Coverage decisions – simplified

What coverage amount do you really need? With so many life insurance options, choosing can feel daunting. Work directly with a Solidly Guide to customize your coverage, making sure you get coverage that gives you the confidence to face every day – and sleep soundly every night.

Oh, and your Guide is on us.

Fast, safe, and easy

These days, talking to a human can feel slow, arduous, and even a little uncomfortable. Our guides make the process quick and painless, creating a tailored quote and a customized policy for you, based on your needs – with zero pressure.

(And we never share your information.)

Benefits Comparison

What You Get

Typical Premiums

All the Living Benefits for a tiny Upgrade Price

Father, 35

only an additional- Real Estate Attorney

- Male, Age 35

- Non-smoker

- Preferred for $250,000

- 20-year Level-Premium Term Life

- Comparing $18.00/mo for traditional life insurance versus $19.26/mo for life insurance plus living benefits

Student, 25

only an additional- Medical Student

- Female, Age 25

- Non-smoker

- Preferred for $500,000

- 20-year Level-Premium Term Life

- Comparing $19.35/mo for traditional life insurance versus $21.88/mo for life insurance plus living benefits

Mom, 40

only an additional- Interior Designer

- Female, Age 40

- Non-smoker

- Preferred for $400,000

- 20-year Level-Premium Term Life

- Comparing $42.95/mo for traditional life insurance versus $51.28/mo for life insurance plus living benefits

Ex-Marine, 53

only an additional- Tech Support Manager

- Male, Age 53

- Smoker

- Preferred for $100,000

- 15-year Level-Premium Term Life

- Comparing $76.04/mo for traditional life insurance versus $89.78/mo for life insurance plus living benefits